About Niverville Credit Union

Since our beginnings in a grocery store in 1948, we’ve been focused on providing affordable community-based banking services every day.

Since our beginnings in a grocery store in 1948, we’ve been focused on providing affordable community-based banking services every day.

Through lasting relationships and competitive, value-added financial solutions, we help our members realize their goals and dreams while enhancing the communities we serve.

To be a neighbourly, people-focused, and financially successful credit union.

Our employees, our members, our communities.

Lead by example in everything we do.

Strong professionalism and confidentiality.

Yours and ours.

The idea of establishing a Credit Union in Niverville originated in a corner grocery store in 1948. On March 17, 1949, a general meeting was held where 23 people signed up, for a total of $150.75 in shares.

On March 21, 1949, the first annual meeting of Niverville Credit Union Society Limited was held at the Community Hall. Bylaws were approved and the first officers were elected.

Our first office was at the Niverville B/A Station, rent-free for two years

The ceiling on a loan was soon raised to $150, and on May 28, 1949, the limit was removed. In 1954 the charter was extended to include the New Bothwell and Randolph areas.

In 1956 the office was relocated to its own building measuring 480 square feet.

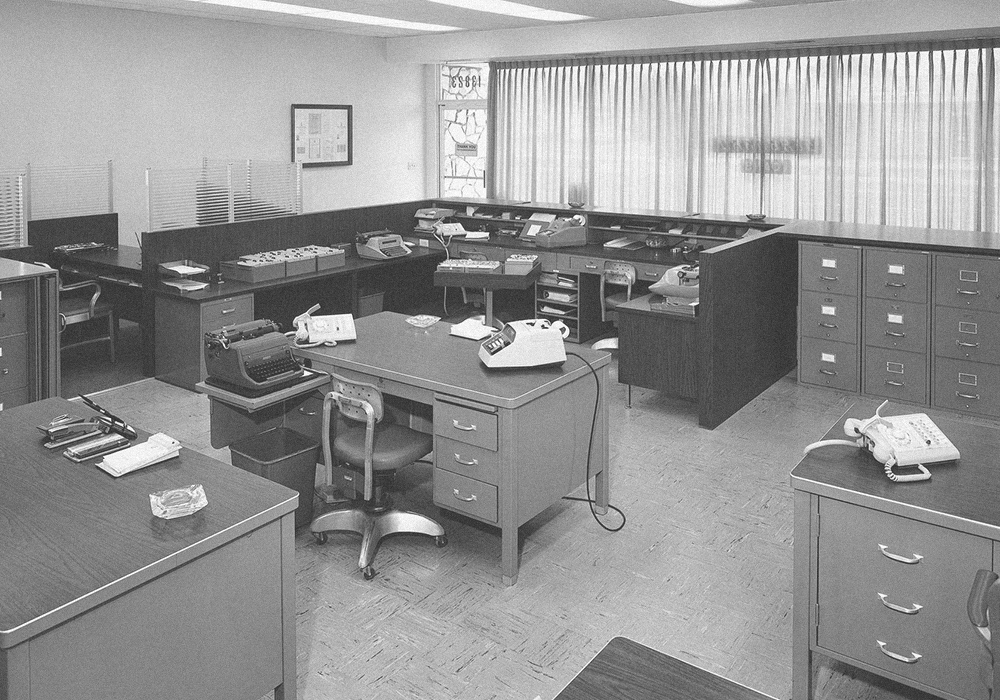

In 1967 we reached assets of $1 million. The same year, a new 2,800 square foot office building was completed. This new building provided modern banking facilities including a night deposit vault and safety deposit box rentals.

By 1977 assets had increased to $12.2 million with 2,500 members. The office building was expanded by some 125 square feet that year.

On September 1, 1983, the Niverville and Landmark credit unions merged. The Landmark office had a total membership of 604 with $834,000 in assets. Loans outstanding were $596,875.

In 1988 we expanded the lobby in our Niverville office and installed an automated teller machine.

June 13, 1998 marked the grand opening of our new building in Landmark. Services at this location were expanded to include an ATM and safety deposit boxes.

This is a tribute to those who had the initiative and courage to organize the credit union–the 23 founding members in 1949, and the directors, committee members, and staff who have supported us since.

Niverville Credit Union has been averaging approximately 8.25% annual growth since 2000.

Whether you are starting a brand-new account or switching from a different financial institution, our neighbourly staff will ensure that the process is easy and stress-free.

We help our members realize their goals and dreams while enhancing the communities we serve.

Chair

1st Vice Chair

Director

Director

Director

Director

Director

Find current job openings with Niverville Credit Union in Niverville, Landmark, and Steinbach.

2024 Annual Report (PDF - 18.91 MB)

2023 Annual Report (PDF - 5.07 MB)

2022 Annual Report (PDF - 2.85 MB)

2021 Annual Report (PDF - 17.18 MB)

2020 Annual Report (PDF - 17.37 MB)

2019 Annual Report (PDF - 23.76 MB)

2018 Annual Report (PDF - 5.58 MB)

2017 Annual Report (PDF - 5.33 MB)

2016 Annual Report (PDF - 9.00 MB)

2016 Financial Statement (PDF - 1.61 MB)

2015 Annual Report (PDF - 8.26 MB)

2015 Financial Statement (PDF - 1.78 MB)

2014 Annual Report (PDF - 2.35 MB)

2014 Financial Statement (PDF - 1.68 MB)

2013 Annual Report (PDF - 2.13 MB)

2013 Financial Statement (PDF - 2.36 MB)

2012 Annual Report (PDF - 5.00 MB)

Learn about our accounts, business credit cards, and more.

Explore personal chequing and savings accounts.

© 2024 Niverville Credit Union. All rights reserved.